We spoke with Le about his trading plan, insights, and lessons gained while trading in the markets and our platform as a funded trader.

Click here for more inspirational lessons and interviews with our professionally funded traders.

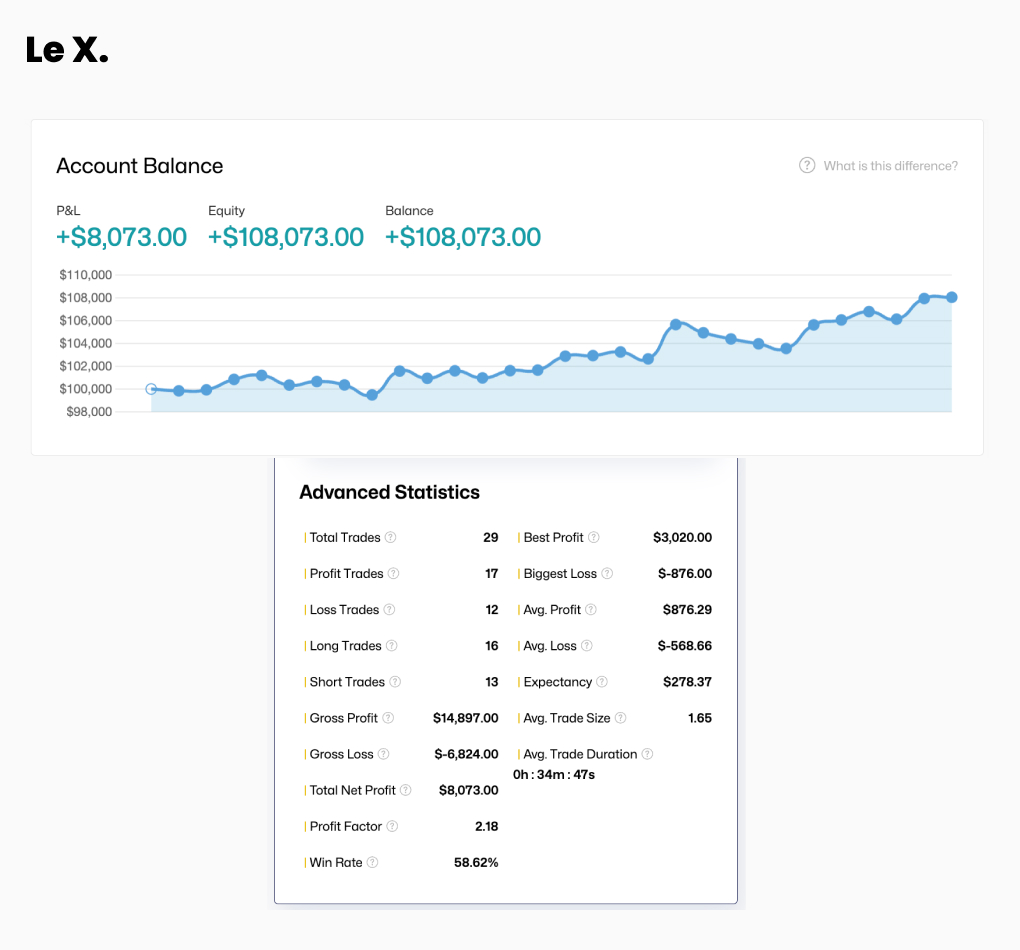

Le’s $100K High Stakes Evaluation Account – Step 1

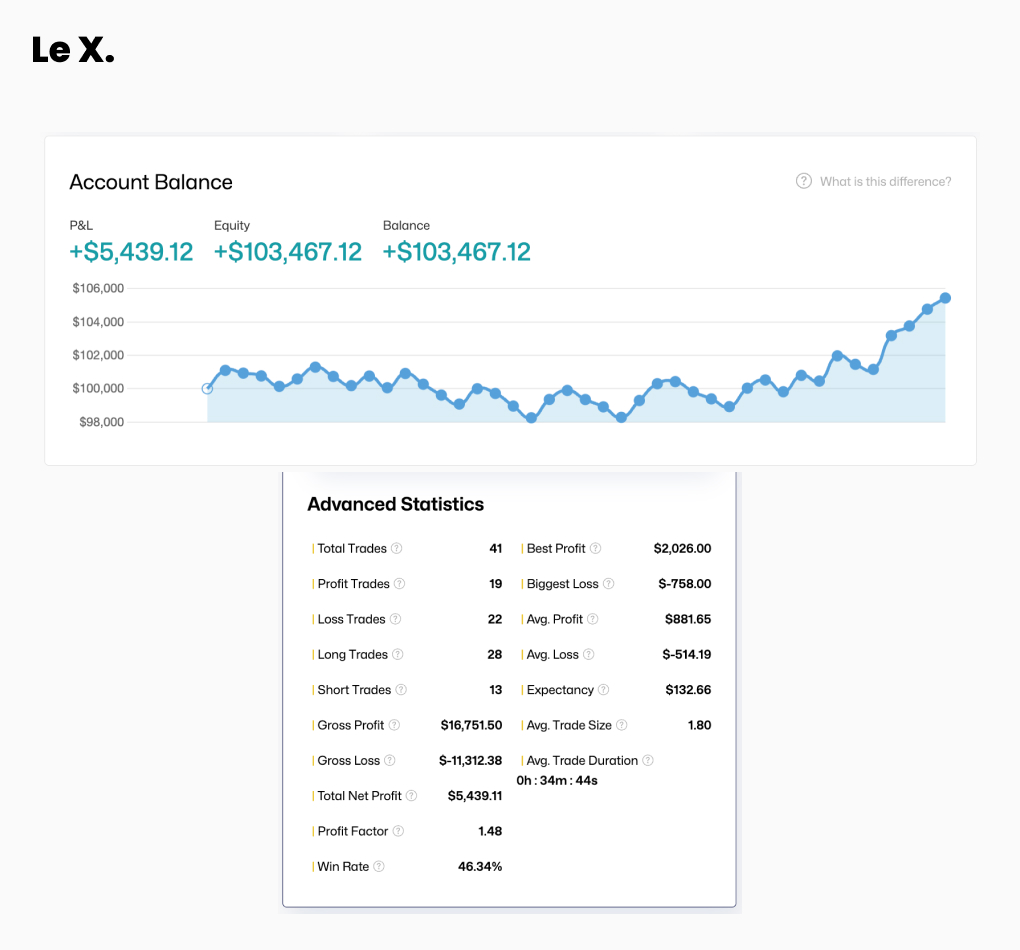

Le’s $100K High Stakes Evaluation Account – Step 2

Tell us a little bit about yourself.

I’m Le Xuan Tan from Vietnam. I trade full-time as a day trader. I focus on disciplined, consistent trading and always seek to improve my strategy and mindset. I enjoy learning from real market experience and truly appreciate the opportunity to grow with a prop firm like The5ers.

How long have you been trading?

I have been trading for 8 years.

Briefly describe your Trading Plan and how it contributes to your success.

I trade according to the market structure trend, use supply and demand areas as entry zones, and use small time frames to place orders.

Share with us a challenge you faced in your trading career and how you overcame it?

My biggest challenge in my trading career is a series of consecutive losses, usually 5 to 10 in a row. I was very impatient and had difficulty controlling my psychology. I fixed this issue by limiting the number of orders per day and extending the time between entries. For example, if I lose 1–2 consecutive orders, I stop and wait 3–4 hours before re-entering. If I continue to lose, I take a break and resume trading the next day. I also set my trading hours to around 14:00 to 23:00 Vietnam time.

How did you adjust risk management to your trading personality?

I realized I perform best when I use lower risk per trade and wait for high-probability setups. I use a fixed % risk model (usually 0.5–0.7%) and never increase position size emotionally. This approach matches my personality and keeps me mentally stable during drawdowns.

How long does it take to become a consistent trader, and what aspects did you change that helped you become consistent?

It took me about 5 years to achieve consistency. I had to change a lot of trading methods, adjust my trading rules, and develop discipline so that it suited my personality and schedule. I simplified my strategy and started treating trading as a serious job.

What is your mental/psychological strength, and how did you develop it?

My strength is patience and emotional control. I developed it by following the plan and always reminding myself that the market will still be there tomorrow. I don’t rush into trades when the requirements aren’t met. I also remind myself that the goal is long-term consistency, not short-term excitement.

What was your strategy to successfully pass The5ers’ evaluation?

As a day trader, I focus on the main trend, especially during the New York session. I trade only one instrument that I know very well: XAU/USD (gold). I follow strict risk management, avoid overtrading, and only take trades that meet all my setup criteria. Staying calm and treating every position like a normal trade helps me stay focused and ultimately helped me pass the first level successfully.

👉 If you want to receive an invitation to our live webinars, trading strategy, and high-quality forex articles, sign up for our Newsletter.

👉 Click here to check our funding programs.

Follow us: 👉YouTube 👉 Linkedin 👉 Instagram 👉 Twitter 👉 TradingView